Endowments are a powerful investment in Oklahoma State’s future as they deliver a dependable, perpetual source of funding. When you establish an endowment, the funds are invested instead of being spent immediately. Each year, a percentage of the return is made available to the university, directed toward the area of your orange passion.

| Your Orange Passion | Endowment Minimum |

|---|---|

| Undergraduate Scholarships | $25K |

| Graduate Fellowships | $50K |

| General Programs | $25K |

| Faculty Support | |

| - Chair | $1M |

| - Professorship | $500K |

| - Lectureship | $100K |

Endowment Basics

Endowments grow over time through long-term investment returns. These returns provide annual distributions to OSU in the form of a spending policy, as well as a small administrative fee.* Together this advances your passion at the university while ensuring the proper stewardship of your investment. Any other earnings are reinvested to continue increasing the impact of your generosity. Because endowments are a long-term investment, we measure the health of our endowment over 10-year periods.

Your Endowed Gift

100% of gifts to your endowment go to support your orange passion

Your Endowment

Your endowed gift is invested in OSU’s endowment and grows to produce annual spending

Your Endowment Spending

4.25% is given to OSU annually to support your orange passion

*A small percentage goes toward the OSU Foundation's administrative fee to ensure the stewardship and long-term growth of your endowment.

Endowment Growth

FY15-FY24

|

|

| FY24 | $1.007B |

| FY23 | $938.7M |

| FY22 | $822.3M |

| FY21 | $813.9M |

| FY20 | $648.5M |

| FY19 | $642.5M |

| FY18 | $642.9M |

| FY17 | $586.7M |

| FY16 | $545.5M |

| FY15 | $581.4M |

FY24 reflects pre-audited amounts

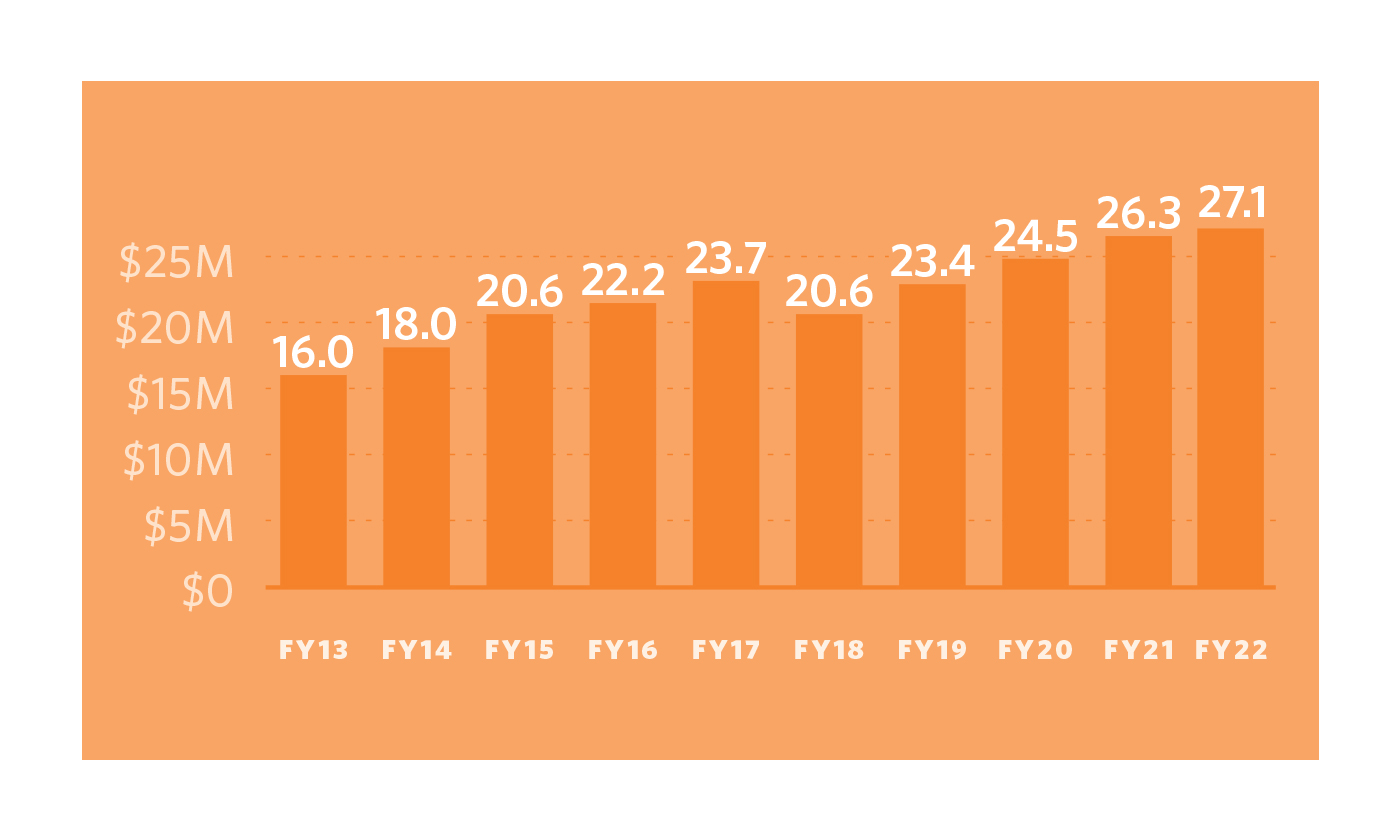

Endowment Spending Available

FY15-FY24

|

|

| FY24 | $35.3M |

| FY23 | $30.5M |

| FY22 | $27.1M |

| FY21 | $26.3M |

| FY20 | $24.5M |

| FY19 | $23.4M |

| FY18 | $20.6M |

| FY17 | $23.7M |

| FY16 | $22.2M |

| FY15 | $20.6M |

Our investment strategy, set by the OSU Foundation Board of Trustees and its Investment Committee, was adopted to preserve the long-range purchasing power of the endowments while prudently managing risk. The OSU Foundation’s pooled investment fund is managed by Multilateral Endowment Management Company (MEMCO) at the direction of the Foundation’s Board of Trustees. Each quarter, the Investment Committee meets to review the pooled investment fund’s performance and policies to ensure investment performance goals are met – all in an effort to provide stable annual spending policy distributions to Oklahoma State University.