A legacy of hard work and generosity

April 2019

A legacy of hard work and generosity

Dorothy Lawson is no stranger to hard work. The 1949 alumnae grew up on a farm in rural Oklahoma, and her first job involved weighing wheat for farmers as they prepared it to be sold. Her strong work ethic grew while she attended Oklahoma State University.

Dorothy followed her interest in business administration, studying both economics and statistics. After completing her undergraduate degree, she began working at the Social Security Administration and pursued law school. These experiences built on the foundation she nurtured for years — planning for retirement is crucial.

After many years of traveling the world, training attorneys and practicing law, Dorothy retired.

“I’ve saved and invested throughout my whole life,” she said. “When I was planning where my estate would go, I wanted to choose something that would be worthy of the hard work I put in.”

In creating those plans, Dorothy always knew she would include her alma mater. “I just loved OSU when I got there,” she said. “It was my school.” She discovered she has several orange passions and decided to split her estate accordingly using a charitable bequest.

Farming runs deep in the Lawson veins, and Dorothy chose to designate part of her estate to the B.N. & Etta Lawson & Dorothy Lawson Memorial Endowed Scholarship for the College of Agricultural Sciences and Natural Resources.

“I have such a love for farming and for farmers,” Dorothy said. “Daddy always said farmers feed the world.” This scholarship will honor the legacy of the Lawson family, supporting the mission of this land-grant university.

Dorothy also has a strong affiliation with the college she attended at OSU, and she designated the other portion of her estate to create the Dorothy A. Lawson Memorial Scholarship for the Spears School of Business. She said that she loved her experience at OSU and wanted to leave a lasting legacy in the areas that affected her most.

Dorothy’s charitable bequest ensures that her estate will offer support to the areas of OSU she is most passionate about.

Learn more about charitable bequests and other giving vehicles!

Learn more about charitable bequests

Who has the best gift under the tree?

November 2018

Who has the best gift under the tree?

Though this can’t be sent via Amazon Prime, the best gift you can give to your family is a plan. Direction and guidance involving your personal and financial affairs will be very beneficial for the time when this information becomes necessary. Providing peace of mind for your family members is one of the most important things you can do for them.

What is your plan? Learn more about how you can plan for your family and OSU.

Follow Santa’s lead and check your list twice.

November 2018

Follow Santa’s lead and check your list twice.

Like any important list, your estate plan needs reviewing — at least every two or three years. Of course, several factors would prompt additional review, such as:

- Marital status change

- Birth, adoption, or death in the family

- Move in residence

- Property acquisition

Another list to review includes the types of assets you can use to create a meaningful estate plan. Click here to learn more.

Deck the halls with boughs of…Post-Its?

November 2018

Deck the halls with boughs of…Post-Its?

Families often gather during the holiday season, telling stories of family heirlooms that have been passed down for generations. Don’t leave the next stories to chance — be sure to indicate in your estate plan how your belongings will be distributed among family members.

A bequest is a great way to make a permanent and transformational impact on the people and organizations that mean the most to you. A bequest may also be an effective way to ease the burden of taxes on your family and your estate while leaving your stamp on Oklahoma State. Follow these link to learn more about Charitable Bequests or to find Sample Bequest Language.

It all started with a partridge in a pear tree.

November 2018

It all started with a partridge in a pear tree.

There are several stages to planning your estate and many different ways for you to leave a legacy. If you’re ready to learn more about how to make your first step, contact GiftPlanning@OSUgiving.com. Our knowledgeable gift planning professionals can help you unite your passions with university priorities. You can also learn more about various opportunities to leave an impact by following this link.

Giving the gift of a continued legacy

September 2018

Giving the gift of a continued legacy

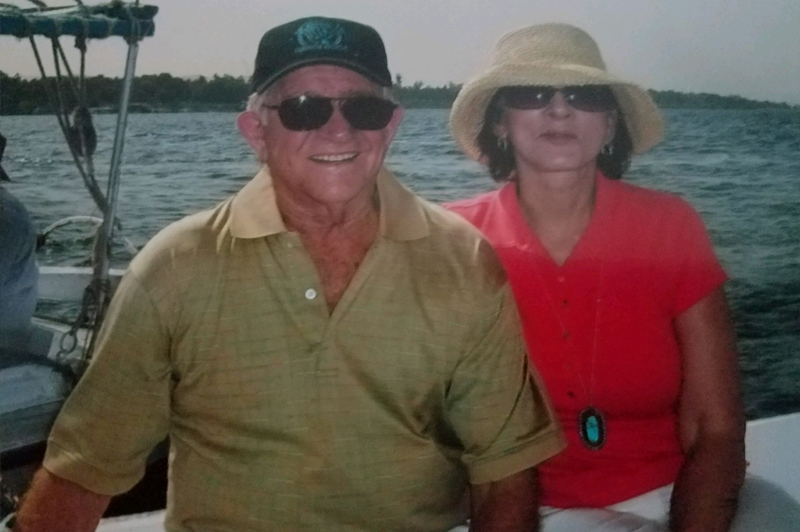

America’s Brightest Orange ran through the veins of John Miller, and he was proud to don his orange and black as an Oklahoma State Cowboy. John graduated in 1959 with a degree in chemical engineering, and his lifelong passion for his alma mater never ceased.

John lived a full life. With the partnership of a wonderful colleague, they started a manufacturing company that sold refinery equipment around the globe, fulfilling his love of travel. His beloved wife, Micki, cheerfully described him as not only successful, but also “the kindest, sweetest person.” He was well-known for being an entrepreneur — even when he would take his friends back and forth to school from Miami, he would charge them a quarter.

These traits stayed with John throughout his life, as he demonstrated care and responsibility as both a husband and father. “He pinched every penny three times,” Micki said. “Except when it came to giving.”

Even with his deep roots for responsibility in finances, he cherished the substantial impact that comes with giving back. After his passing in 2010, Micki made the decision to continue building his legacy through an estate planning gift of her own.

Through a retirement plan beneficiary, Micki is creating opportunities for students that follow in John’s footsteps through the John H. Miller CEAT endowed scholarship.

“I wanted to leave this scholarship in his name,” Micki said. “John loved his school — he just loved it!”

There are several options through which you can create your legacy. Our planned giving staff is always happy to provide additional information and answer questions. You can contact Sarah Brown at sbrown@osugiving.com, or call 405-385-5151.

Opportunities using retirement plans

A lifelong passion for OSU

September 2018

A lifelong passion for OSU

Growing up in a household that was filled with orange and black, Joe Holcomb was born a fan of Oklahoma State University.

As an undergraduate student at OSU, Joe embraced his Cowboy spirit, joining both the cheerleading squad and the brotherhood of Pi Kappa Phi. While being fully immersed in extra-curriculars, he didn’t slow down. As a double-major in business administration and journalism, he soaked up every moment of his experience.

While Joe’s career eventually took him away from Stillwater, he remained connected to campus through reunions and friendships with his cheer team and fraternity brothers.

His love for OSU is still growing.

Joe said he has always had an affinity for the arts — an area that is undergoing significant transformation at OSU. “I shared my passion regarding the arts with Diana Lasswell and she connected me to Dr. Kimbrough,” he said. “They took me on a tour of the theatre department, and I got to see the students working as he talked with me about the needs of the department.”

It wasn’t long before Joe was ready to support this program. “Through my connection with the Foundation – and Diana Lasswell in particular – I learned about being able to leave an appreciation for the university through planned giving.”

Joe set up his estate gift, with the help of the OSU Foundation Office of Gift Planning, to support theatre students for years to come. Dr. Kimbrough, faculty member and former head of the theatre department, is incredibly grateful for this generosity — and Joe knows it. “He remains in regular contact with me,” said Joe, further discussing the friendships that have resulted from his involvement. “I’ve made a pledge through the Heritage Society. That has been a really great opportunity for me and has opened my eyes to a lot of things going on in the theatre department.”

The Heritage Society has brought more to Joe than he could have ever imagined. “I love coming up to the university and visiting with Diana and the friends I’ve made through the Foundation. It’s been a way for me to leave a legacy that is also giving me strong, lasting friendships that I wouldn’t have if I weren’t connected with the Foundation and the Heritage Society. I think it’s so important that we give back to the university and the community that has given so much to us.”

2018 Fall engagement opportunities

September 2018

2018 Fall engagement opportunities

1890 Gathering Tailgate

Saturday, October 6th at 12:30 p.m. | OSU vs. Iowa State

If you are interested in more information, please contact Sarah Brown at sbrown@osugiving.com, or call 405-385-5151.

Saturday, October 27th | OSU vs. Texas – Homecoming!

If you are interested in more information, please contact Sarah Brown at sbrown@osugiving.com, or call 405-385-5151.

Charitable Gift Annuity: the perfect choice!

July 2018

Charitable Gift Annuity: the perfect choice!

Pedro Pantoja, a 1961 OSU entomology graduate, continues supporting his alma mater through a charitable gift annuity.

Pedro Pantoja, a 1961 OSU entomology graduate, continues supporting his alma mater through a charitable gift annuity.

Moving to Oklahoma from his home country of Mexico at 19-years-old, Pantoja was quick to find a new home amongst the orange and black. “I always wanted to come to America,” he said, reminiscing about his venture to OSU. “People here were very friendly.”

After graduating, Pantoja spent many years thriving in his career, visiting more than 90 countries around the world and making memories with his family. He credits much of his success to his time at OSU, as he had wonderful professors and mentors.

“When I finished college, my teachers helped me get a job. These people opened doors for me,” he said.

When Pantoja wanted to show his utmost gratitude for the opportunities made available by his alma mater, he chose to open a charitable gift annuity.

“My kids are working, travelling and doing very well, and I’m glad to be generous to other people.” Pantoja said, thinking back to the financial support he received as a student.

Through planned giving, he wants to pay-it-forward. “For me, Oklahoma is home. I love Oklahoma State University.”

Through his charitable gift annuity, Pantoja supports OSU while receiving a guaranteed fixed payment for life. The substantial reduction in income tax is beneficial, and this giving vehicle provides dependability for the security-minded.

New rates for charitable gift annuities, which will provide higher monthly income for policy holders, are effective July 1, 2018. Click here to learn more about the rate changes. Of course, our friendly staff is always happy to answer questions. You can contact Sarah Brown at sbrown@osugiving.com, or call 405-385-5151.

Charitable Gift Annuity Rates Have Increased

July 2018

Charitable Gift Annuity Rates Have Increased

Through a charitable gift annuity, you transfer cash or an appreciated property to the OSU Foundation. In return, you are promised a fixed payment for life, with rates based on your age. You can even defer the payments to begin later, such as at retirement, or designate them to another beneficiary, such as a loved one. Some of the income may be tax-free as well.

United States tax laws encourage charitable gifts and embrace philanthropic-planning strategies such as charitable gift annuities. These strategies can give you the opportunity to transform the future of Oklahoma State University. Click here to learn more about these changes. Follow this link to view states that issue charitable gift annuities

This is just one of many ways you can choose to support OSU through a planned gift. You can read about others on our Estate Planning page. Our friendly staff is also happy to answer your questions and help you determine the best options for your particular situation. You can contact Sarah Brown at sbrown@osugiving.com, or call 405-385-5151.

Is an IRA giving avenue right for you?

July 2018

Is an IRA giving avenue right for you?

For several Oklahoma State University supporters, the opportunity for building the future of education is powerful. That was a key motivator for Richard and Melody Hatfield when they chose to create a planned gift at OSU. With two options to give through an IRA, they were eager to get involved.

Richard spoke extensively of the experiences he’s had as a result of his OSU degree. “I give the university the credit for my life,” he said. “They gave me the opportunity to do a lot of things that I could have never done, so I try to give back to them.”

The Hatfields chose to leave a lasting legacy at OSU by including the university as a beneficiary of their IRA. This giving vehicle allows them to designate their gift to a specific fund — the Richard G. Hatfield and Melody N. Hatfield Endowed Scholarship, which was started by the couple.

The Hatfields chose to leave a lasting legacy at OSU by including the university as a beneficiary of their IRA. This giving vehicle allows them to designate their gift to a specific fund — the Richard G. Hatfield and Melody N. Hatfield Endowed Scholarship, which was started by the couple.

The second avenue for giving through an IRA is through the required minimum distribution. This option allows friends and alumni that have reached the age of 70 ½ to designate their minimum distribution as a gift to OSU.

Using an IRA to give through the required minimum distribution (RMD) leaves a lifelong impact at OSU. Gifts up to $100,000 per year can be transferred through this avenue, and these funds are not taxable. Because the RMD requires certain funds to be withdrawn from an IRA annually, this is a wonderful opportunity to support Oklahoma State University — and it’s tax-free!

Both of these IRA avenues are incredible options to make a difference at Oklahoma State. Our friendly planned giving staff is always happy to answer questions. You can contact Sarah Brown at sbrown@osugiving.com, or call 405-385-5151.

Engagement Opportunities

July 2018

Engagement Opportunities

Doel Reed Center for the Arts Leisure Learning Classes

October 4-6, 2018 Enroll Here

1890 Gathering Tailgate

Thursday, August 30th at 5:00 p.m.

Look for us outside the Sherman P. Smith Practice field!